Views: 66

The general idea of a progressive European energy market is to deliver quality energy services and products to citizens and industries. Besides, it is vital to create an integrated energy market with cross-countries’ infrastructure to provide security in energy supply and price stability. Such a market will allows the EU member states to exchange electricity with each others in most economic and efficient way. Some immediate and medium-term measures in dealing with the present crisis are already suggested by the EU institutions.

Energy mix: present and future

The energy mix is a group of different primary energy sources (suitable for end use without conversion to another form) and “manufactured” secondary energy sources for direct use (mainly electricity). Energy mix refers to all direct uses of energy, such as transportation, housing etc.; hence, it is not be confused with power generation mix, which refers mainly to generation of electricity. Examples of primary energy resources are wind and solar power, wood fuel, other fossil fuels, e.g. coal, oil, natural gas and uranium; secondary resources are those such as electricity, hydrogen, or other synthetic fuels. Usually “renewable” resources are those that recover their capacity in time for prolong and indefinite human needs.

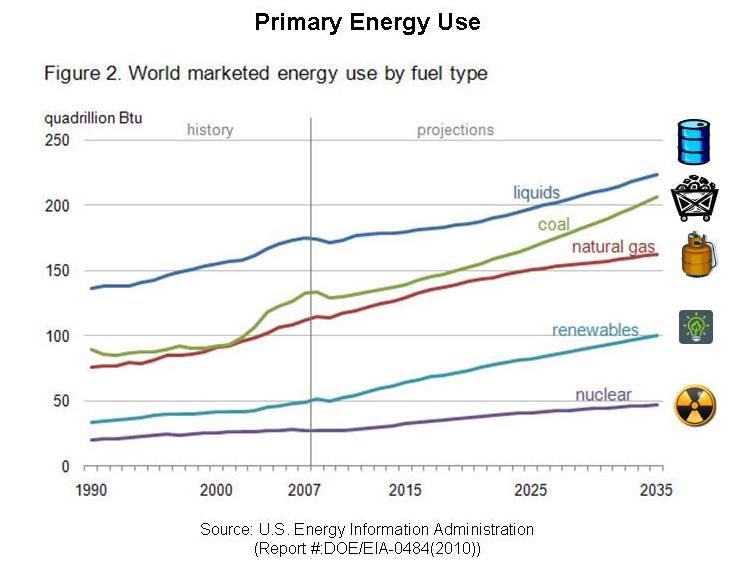

According to the International Energy Agency, about 14 percent of world primary energy is used by the European Union: about 76 percent is coming from fossil fuels, 14 percent from nuclear energy, 7 percent from biofuels, about 3 percent from renewable energy resources. For example, out of about 4 million GWh of electricity were generated in the US, 67% is generated from fossil fuels (coal, natural gas, petroleum), 20% from nuclear power, 6% hydropower and 7% from other renewables. Oil will make about 28 percent of the global energy mix by 2040, gas will increase to the level of 30 percent (together with oil, it will make about 60 percent), renewables (mainly wind and sun) will increase three-fold, modern bioenergy will almost double; coal will still be at the level of 20 percent in global energy mix by 2040. See Figure 2 below.

Source: https://www.visualcapitalist.com/the-worlds-projected-energy-mix-2018-2040/

The EU internal energy market

Before the EU internal energy market is being established, the European energy system was based on a number of national energy monopolies, when prices were set by regulators, leading to an expensive, inefficient system that did not allow customers to benefit from competition between energy companies; the EU internal energy market is aimed at changing this situation. The current market design allows the EU states and citizens to choose between different electricity and gas suppliers and provides clear price signals to increase investment incentives in renewables and sustainability. By connecting 27 national energy markets, the integrated EU market is going to bring costs down, reduce CO2 emissions and enhances security of supply. The internal market also facilitates consumer empowerment, e.g. through creating “joined energy communities” and/or producing their own electricity.

Presently, the EU internal energy market functions through the following means: a) as an inter-connected market, providing energy at affordable cost; i.e. operators compete to offer the cheapest energy; b) ensuring security of supply through sharing energy across borders to increase energy flexibility; c) reducing price differences and price volatility among the member states; d) boosting competitiveness through forcing energy retailers to innovate, develop new business models, and invest in renewables; and e) by supporting the green transition: i.e. through introducing more renewable energy sources into national energy mix.

Electricity in the energy market

The wholesale electricity is composed of energy producers (e.g. power plants), those selling electricity, as well as energy retailers who buy and deliver it to clients. There is a so-called “marginal” pricing system, which is imposed on power plants by a price order starting with the least expensive and going until the last plant is dispatched to meet consumers’ demand. It is this last plant that sets the overall price, and which it is often (in the hours of higher consumer demand) a gas or coal power plant.

All electricity producers are paid the same price for their “electricity product: there is general consensus that the marginal model is the most efficient for liberalized electricity markets because generators have an interest not to bid higher than their actual operating costs. Other systems lead to more inefficient outcomes and favour speculation, to the detriment of consumers.

The market also works across borders through a process known as “market coupling”, which ensures efficient markets where electricity flows from areas with lower electricity prices to those with higher prices. This keeps electricity costs down for consumers throughout the EU and means that the states can rely on supplies from their neighbors when needed, supporting security of electricity supply. Electricity producers and suppliers also trade on forward markets: the forward prices reflect periods of high and low demand and allow both producers and suppliers to reduce the risks of short-term movements in energy prices. Effective forward markets can also be a vital part of the internal energy market, as the wholesale electricity price is one of the components of the final electricity bill paid by consumers; the latter reflects the costs of transporting and distributing it (network costs) including taxes and levies. On average, each of the three electricity bill components makes up one third of the total bill, with some variation among the EU states.

However, with the current wholesale electricity price being driven up by global gas prices, the present market model seems inappropriate: as the price spikes are driven by global conditions, it is unlikely that alternative market models would produce better outcomes. Nevertheless, the Commission is now tasking the Agency of European Energy Regulators ACER to look into the benefits and drawbacks of the current market model, as well as its implementation by the member states, to ensure that the market design continues to be efficient.

Global economic recovery and energy prices

Present energy’s spike is principally driven by increased global demand for energy, in particular gas, linked to the global economic recovery; such energy price fluctuations have occurred in the past, but the current situation is exceptional as European households and companies are facing higher energy bills at a time of income losses due to COVID. This situation endanger the EU’s recovery and exacerbate energy poverty; it also risks undermining confidence and support in the clean energy transition which is required not just to avert disastrous climate change but also to reduce the EU’s vulnerability to fossil fuel price volatility.

The EU’s policy framework already allows the states to take a series of targeted measures to protect vulnerable consumers and mitigate the impacts on industry: most states have already taken some measures towards coordinated approach in mitigating risks and addressing negative effects of sudden price hikes to ensure affordability without fragmenting the European single energy market or jeopardizing investments in the energy sector and the green transition.

While energy supply is not at immediate risk and the markets currently expect wholesale gas prices to stabilize at a lower level by April 2022, security of supply, gas storage levels and the proper functioning of the gas market need a particular monitoring ahead of the winter season. In addition to short term measures, the Commission Communication (see below) provides an outlook onto coordinated measures to be taken in immediate and medium-term to ensure a better preparedness to gas price fluctuations while reducing the EU’s dependence on fossil fuels.

Rapid and coordinated EU’s response

European Network of Transmission System Operators for Gas (ENTSO-G), the Commission is closely monitoring the security of supply situation, including the level of gas storage and imports. According to the EU rules, ENTSO-G published its “Winter Outlook” this October to assess the capacity of the gas network to cope with possible problems during the next winter; the outlook shows that the European gas infrastructure offers sufficient flexibility this winter.

The current price spike requires a rapid and coordinated response: existing legal framework enables the EU and the states to address the effects of sudden price fluctuations. The immediate response should prioritise measures that can rapidly mitigate the effects on vulnerable groups, can easily be adjusted when the situation improves, and avoid interfering with market dynamics or dampening incentives for the transition to a decarbonised economy. In the medium term, the policy response should focus on making the EU more efficient in the use of energy, less dependent on fossil fuels and more resilient to energy price spikes, while providing affordable and clean energy to end-users (more on these measures below).

The Commission’s immediate measures are aimed to reduce negative impact on households and businesses this winter; at the same time, the medium-term measures are to ensure that the EU energy system is resilient and flexible to withstand any future volatility throughout the transition.

Among specific immediate measures to protect consumers and businesses are:

- Providing emergency income support for energy-poor consumers, e.g. through vouchers or partial bill payments, which can be supported with EU ETS revenues;

- Authorizing temporary deferrals of bill payments;

- Putting in place safeguards to avoid disconnections from the grid;

- Providing temporary and targeted reductions in taxation rates for vulnerable households;

- Providing aid to companies and/or industries according to the EU state aid rules;

- Enhancing international energy outreach to ensure the transparency, liquidity and flexibility of international markets;

- Investigating possible anti-competitive behavior in the energy market, which required the European Securities and Markets Authority (ESMA) to further enhance monitoring of developments in the carbon market;

- Facilitating a wider access to renewable power purchase agreements and support them via flanking measures.

Among medium-term measures for a decarbonised and resilient energy system there are the following:

- Step up investments in renewables, renovations and energy efficiency and speed up renewables auctions and permitting processes;

- Develop energy storage capacity, to support the evolving renewables share, including batteries and hydrogen;

- Require the European energy regulators (ACER) to study the benefits and drawbacks of the existing electricity market design and make specific recommendations to the Commission;

- Consider revising the security of supply regulation to ensure a better use and functioning of gas storage in Europe;

- Explore the potential benefits of voluntary joint procurement by the member states of their gas stocks;

- Set up new cross-border regional gas risk groups to analyse risks and advise the states on the design of their national preventive and emergency action plans;

- Boost the role of consumers in the energy market, i.e. by empowering them to choose and change suppliers, generate their own electricity and join energy communities;

- Adopt a rule book for cybersecurity for electricity;

- Propose, by December 2021, a Council Recommendation providing further guidance to the member States on how best to address the social and labour aspects of the green transition.

Source: https://ec.europa.eu/commission/presscorner/detail/en/ip_21_5204; See also the EU’s Communication: https://ec.europa.eu/energy/sites/default/files/tackling_rising_energy_prices_a_toolbox_for_action_and_support.pdf

The EU energy market intends to keep down the costs of the clean energy transition, enabling the states to share reserves and flexibility, rather than needing to invest alone. More electrification in our energy system is an important part of the green transition, as it’s the easiest way to increase the share of renewable energy we use. Renewables have become the cheapest electricity source available in Europe, and the number of days when they are the sole supplier of the grid is growing each year.

Suggested model for electricity market

The internal energy market allows for the deployment of cheapest energy: the model provides efficiency, transparency and incentives to keep down the costs. There is general consensus among the EU states that the marginal model is the best for liberalized electricity markets, with only wholesale prices to be set at EU level: thus, when there is sufficient supply of renewables to meet demand, prices are at their lowest as other power sources don’t need to be switched on. When more energy is needed, more expensive power plants need to be switched on, and they set the price which all suppliers receive.

However, presently gas-powered plants are still needed to generate electricity in numerous EU states, which are actually setting the price, but often consumers can choose among different suppliers. Switching suppliers should be free of charge for households and small businesses, and take no longer than three weeks (even 24 hours if smart meters are rolled out). In 2019-2020, over 15 percent of consumers switched contracts in Belgium, Ireland, the Netherlands and Portugal.

Main components in the EU consumer’s electricity bill is made up of three elements, each accounting usually for roughly one third of the price: electricity generation (the cost of making power), network charges (the cost of delivering power), as well as taxes and levies; but the exact composition of the bill varies in the EU member states.

Presently, the global gas market has impacted European electricity bills; hence, electricity produced from gas usually sets the price in the European markets. The current gas price rise results primarily from supply shortages and higher demand for gas in global markets due to the economic recovery in the aftermath of COVID-19.

However, carbon pricing doesn’t impact European electricity bills generally, as the EU Emissions Trading System (ETS) does not levy any fees directly from consumers, but the cost of buying emission allowances is usually passed on to consumers by energy companies. The rising carbon prices over the last year have affected slightly the wholesale electricity prices, but the effect of the higher gas price is currently 9 times stronger than that of the ETS price. According Eurostat, household price components in 2020 increased by rise in gas prices with about €90/mwh; while the ETS’ contribution was about €10/mwh for electricity produced from gas.

References to: https://ec.europa.eu/commission/presscorner/detail/en/FS_21_5212 and https://ec.europa.eu/commission/presscorner/detail/en/FS_21_5213

More information on the issues in the following Commission’s web-pages: = Communication on Energy Prices; =Questions and Answers on the Communication on Energy Prices; = Factsheet on the EU Energy Market and Energy Prices; = Factsheet on the toolbox; = EU energy prices webpage